LIC performance for April-June (Q1) of FY 2024-2025

The Board of Directors of Life Insurance Corporation of India (“LIC”) approved and adopted the standalone and consolidated financial results for the quarter ending June 30th, 2024. Below are the key highlights of our standalone results.

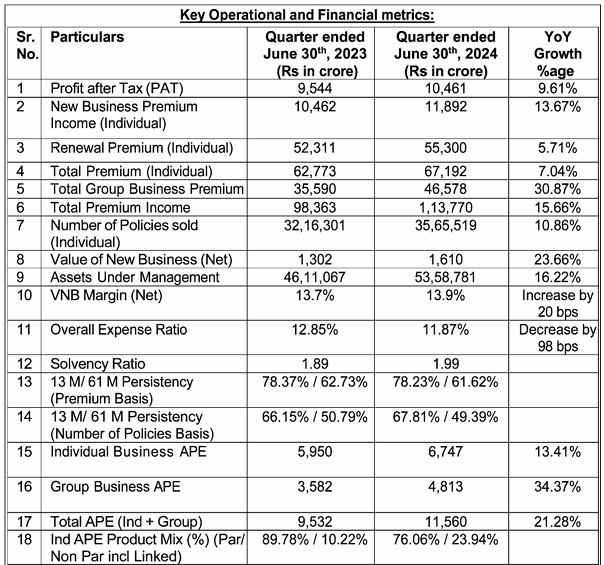

The Profit after Tax (PAT) for the quarter ended June 30th, 2024 was Rs. 10,461 crore as compared to Rs. 9,544 crore for the quarter ended June 30th, 2023 registering a growth of 9.61%.

In terms of market share measured by First Year Premium Income (FYPI) (as per IRDAI), LIC continues to be the market leader by market share in Indian life insurance business with overall market share of 64.02%. For the quarter ended June 30th, 2024, LIC had a market share of 39.27% in Individual business and 76.59% in the Group business.

- Profit After Tax increased by 9.61% to Rs. 10,461 crores.

- Overall Market share by First Year Premium Income (FYPI) increased to 64.02% from 61.42% on YoY basis.

- Total Premium Income increased by 15.66% to Rs. 1,13,770 crore

- New Business Premium Income (Individual) increased by 13.67% to Rs. 11,892 crore.

- Overall APE increases by 21.28% to Rs. 11,560 crore.

- Individual Business Non Par APE increased by 165.63% to Rs 1,615 crore.

- Group Business APE increased by 34.37% to Rs. 4,813 crore

- Non Par APE share within Individual business at 23.94% for Q1 FY25 as compared to 10.22% in Q1 FY24.

- Value of New Business (VNB) increased by 23.66% to Rs 1,610 crore.

- VNB Margin (Net) increased by 20 bps to 13.9%

- AUM increased by 16.22% to Rs 53.59 lakh crore.

- Solvency Ratio increased to 1.99 from 1.89

- Overall expense ratio reduced by 98 bps to 11.87% from 12.85%

The Total Premium Income for quarter ended June 30th, 2024 was Rs. 1,13,770 crore as compared to Rs. 98,363 crore for the quarter ended June 30th 2023, registering a growth of 15.66%. The Total Individual Business Premium for the quarter ended June 30th, 2024 increased to Rs. 67,192 crore from Rs. 62,773 crore for the comparable period of previous year, showing an increase of 7.04%. The Group Business total premium income for quarter ended June 30th, 2024 was Rs. 46,578 crores as compared to Rs 35,590 crore for the quarter ended June 30th 2023, showing an increase of 30.87%.

A total of 35,65,519 policies were sold in the individual segment during the quarter ended June 30th, 2024 as compared to 32,16,301 policies sold during the quarter ended June 30th 2023 registering a growth of 10.86%.

On an Annualized Premium Equivalent (APE) basis, the total premium was Rs. 11,560 crore for the quarter ended June 30th, 2024. Of this 58.37% (Rs. 6,747 crore) was accounted for by the Individual Business and 41.63% (Rs. 4,813 crore) by the Group Business. Within the Individual Business the share of Par products on APE basis was 76.06% (Rs. 5,132 crore) and balance 23.94% (Rs. 1,615 crore) was due to Non Par products. The Non Par APE has increased from Rs. 608 crore for the quarter ended June 30th, 2023 to Rs. 1,615 crore for the quarter ended June 30th, 2024 registering a growth of 1 6 5 . 6 3 %. Therefore, on an APE basis, our Non Par share of Individual business, which was 10.22% for the quarter ended June 30th, 2023 has grown to 23.94% for the quarter ended June 30th, 2024.

The Value of New Business (VNB) for the quarter ended June 30th, 2024 was Rs. 1,610 crore as compared to Rs. 1,302 crore for the quarter ended June 30th, 2023, registering a growth of 23.66%. The net VNB margin for the quarter ended June 30th, 2024 increased by 20 bps to 13.9% as compared to 13.7% for the quarter ended June 30th, 2023.

The Solvency Ratio as on June 30th, 2024 increased to 1.99 as against 1.89 on June 30th, 2023.

For the quarter ended June 30th, 2024, the persistency ratios on premium basis for the 13th month and 61st month were 78.23% and 61.62%, respectively. The comparable persistency ratios for the corresponding quarter ended June 30th, 2023 were 78.37% and 62.73%, respectively.

For the quarter ended June 30th, 2024, the persistency ratios on number of policies basis for the 13th month and 61st month were 67.81% and 49.39%, respectively. The comparable persistency ratios for the corresponding period ended June 30th, 2023 were 66.15% and 50.79%, respectively.

The Assets Under Management (AUM) increased to Rs. 53,58,781 crore as on June 30th, 2024 as compared to Rs. 46,11,067 crore on June 30th, 2023 registering an increase of 16.22% year on year.

The Overall Expense Ratio for the quarter ended June 30th, 2024 was 11.87% as compared to 12.85% for the quarter ended June 30th 2023, registering a decrease of 98 bps.

The Yield on Investments on policyholders funds excluding unrealized gains was 8.54% for the quarter ended June 30th, 2024 as against 8.78% for quarter ended June 30th, 2023.

Shri Siddhartha Mohanty, CEO & MD, LIC said :–

“During the first quarter of this financial year, our market share increased to 64.02% as compared to 61.42% for the same quarter of previous year and 58.87% for the full year ended March 31, 2024. LIC is progressing on its stated objective of gaining market share after having focused, during the last year, on consolidating changes in product mix, channel mix and margin improvement. The momentum around increasing share of Non Par products within Individual segment continues and our Non Par Share, on an APE basis, within the Individual business has increased to 23.94% in the first quarter of FY25 as compared to 10.22% for the same quarter last year. While achieving these growth parameters our margin is stable and our expenses ratio has declined by 98 bps to 11.87% in this quarter. As leader of the insurance industry in India we are conscious of our responsibility to deliver enhanced insurance penetration and we look forward to working with the regulatory authorities to achieve the same. We are committed to further optimizing our product and channel mix and improvement of margins. With the digital transformation exercise underway we intend to create a seamless experience for our customers and partners. We thank our customers, shareholders, distribution partners and employees whose continuous support allows us to create superior sustainable value as we move to next stage of our journey.”