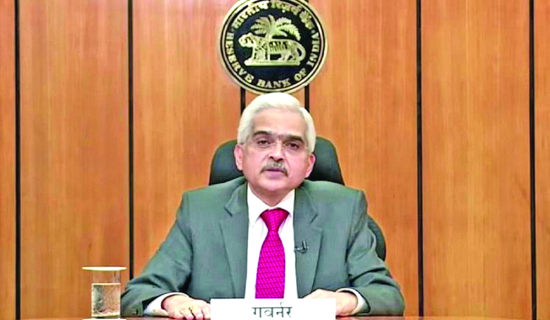

RBI Governor Das says worst of inflation is behind

STATE TIMES NEWS

Mumbai: Reserve Bank governor Shaktikanta Das on Friday said despite the multiple shocks to the global economy from the pandemic, the Ukraine war and synchronised monetary policy tightening across the world, the domestic economy and financial sector are stable and the worst of inflation is behind us.

He also said the rupee has exhibited the least volatility among its peer currencies despite the massive appreciation of the greenback.

Delivering the 17th KP Hormis (Federal Bank founder) commemorative lecture in Kochi this evening, Das underlined that despite the overwhelming concerns a few months back about an imminent global recession, the global economy has shown greater resilience, reducing the probability of a hard landing.

The governor said there is a declining trend in global growth. There is also considerable uncertainty about structural shifts taking place in the drivers of inflation, ranging from labour market dynamics to the concentration of market power and less efficient supply chains.

However, reassuring aspects are global food, energy and other commodity prices have softened from respective peaks and the supply chains are normalising, which should help in achieving disinflation and thus contain imported inflation, he added.

Speaking on the role of India in helping navigate the many emergent crises as it helms the G20 presidency, he said this global role comes to the country in an environment of formidable geo-economic shifts, which have vitiated the global macro-financial outlook.

The capacity of the existing global economic order to manage the severe impact of the multiple shocks is under challenge, leading to severe supply-demand imbalances in critical sectors and giving rise to high inflation in almost all countries.

One key such challenge is fighting the globalisation of inflation– which has soared to multi-decadal highs amid subdued global growth. It has posed complex policy challenges.

As the premier forum for promoting cooperative and effective solutions to global problems, the task of the G20 is cut out, given the difficulties in building consensus and the uncertainty around the outlook on geopolitics, he said and underlined that the ongoing global crisis is both an opportunity and major test for G20, which represents 85 per cent of world GDP and 75 per cent of global trade.

Quoting the IMF he said with the Ukraine war geopolitics has now been taken over by geo-economics and due to this, the global economy is now experiencing a process of geo-economic fragmentation, operating through five key channels of trade, technology, capital flows, labour mobility and global governance.

Of the multiple risks facing the world community, the surge in inflation has posed a complex monetary policy dilemma in every economy between raising interest rates enough to tame inflation, and at the same time, minimising the growth sacrifice to avoid a hard landing, he said.

On the impact of the dollar’s rise against countries with high external debt, he called upon G20 nations to support those countries so that there is no chance of another global crisis due to this.

He also urged the groupings of the world’s largest 20 economies to ensure that the more vulnerable nations get timely and adequate climate financing.

The aggressive and synchronised monetary policy tightening by systemic central banks since early 2022 and the consequent appreciation of the dollar have led to several economies, with a high share of external debt, becoming highly vulnerable to debt distress, he noted.

Quoting the IMF numbers he said, as much as 15 per cent of the low-income countries are estimated to be already in debt distress, with an additional 45 per cent at high risk of debt distress. About 25 per cent of EMs are also at high risk.

However, the governor said there is nothing to worry about for us on this front, as our external debt is minimal to our balances and the economic growth rate.

The dollar rise has further led to massive capital outflows, resulting in reserve losses, sharp currency depreciations and spiralling imported inflation pressures. In such a situation, addressing the deteriorating debt situation in low and middle-income countries and facilitating coordinated debt treatment by official bilateral and private creditors under a multilateral framework must assume priority for G20, he said.

Summing up, Das said our G20 presidency must focus on digital public infrastructure for financial inclusion, climate change and mitigation to achieve a more inclusive global economic order.

The G20 countries have a major responsibility in providing leadership for global action on climate change and provision of climate finance, together with the transfer of technology, to take this agenda forward, he concluded.