A Simple Approach to Financial Freedom

Financial freedom is a goal which almost every other individual aspires for. As a means to help individuals achieve it and several other financials goals, ICICI Prudential Mutual Fund has a unique feature in the form of Freedom SIP. Freedom SIP is a unique investment feature that combines the power of a Systematic Investment Plan (SIP) with a Systematic Withdrawal Plan (SWP). Through this feature, investors can grow their wealth over a period and then start receiving regular cash flow through SWP,post completion of SIP period. How Freedom SIP Works Freedom SIP is a three step process. To bring with, investors have to choose a source scheme in which they will invest through SIPacross 8 years, 10 years, 12 years, 15 years, 20 years, 25 years or 30 years.Since the time frame is typically long, investors can choose from a wide range of equity offering to SIP into.

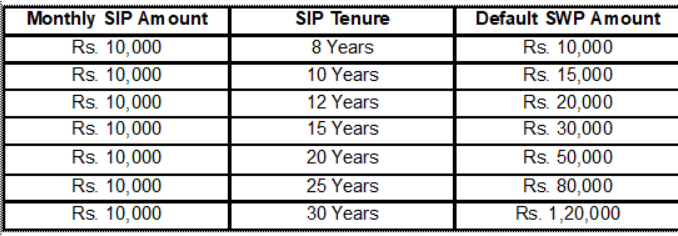

After the stated tenure is complete, the money will be transferred to a target scheme. The target scheme is the scheme from which the investor will receive regular cash flow through SWP. Given the objective of the target scheme is to behave like a holding fund, it is best to choose a hybrid or a debt fund as it is necessary to protect the corpus created over the years from market volatility. From this fund, the SWP will continue as long as there is money available. Investors have the freedom to choose their desired SWP amount. If they do not mention the SWP amount, they will receive the default SWP amount, which would vary based on the SIP amount and the SIP tenure selected by them. For example: If an investor starts an SIP of Rs. 10,000, for a period of 10 years, the SWP amount would be Rs. 15,000. Extend the investment timeframe to 15 years, the SWP amount would be Rs. 30,000. If one continues the investment for 20, 25 and 30 years, the SWP amount would be to the tune of Rs. 50,000, Rs. 80,000 and Rs. 1.2 lakhs.

The SWP will be processed till the units are available in the target scheme. Please note the default SWP amounts will vary based on the SIP amount invested and the tenure selected by the investor.The default monthly SWP payout amounts indicates the likely amount that can be withdrawn. Please read the terms and conditions in the application form before investing. Advantages of Freedom SIP “Consistent Cash Flow: Freedom SIP allows investors to receive regular cash flow after completing the SIP tenure. This helpsensure investors have a steady cash stream to meet their planned expenses. “Flexibility: Investors have the flexibilityto choose the source scheme, target scheme, and the tenure of the SIP. There is also an annual top-up available. “Helps Maintain Financial Discipline: The feature ensures that both SIP and SWP is done in a staggered manner thereby protecting the investor from behavioural challenges. Benefits of Investing through Freedom SIP In this manner, by signing up for a feature like Freedom SIP, one’s aim of meeting the financial goal a decade or more down the line will be achieved in a hassle free manner.