LIC of India introduces new plan Jeevan Dhara II

STATE TIMES NEWS

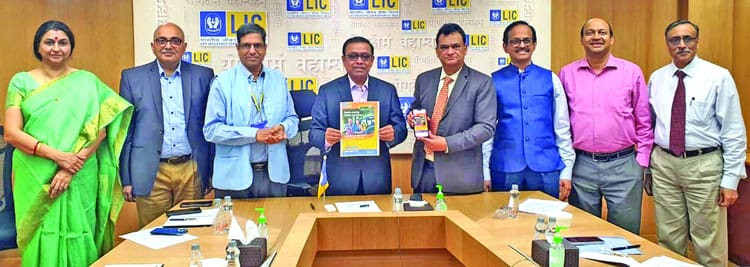

MUMBAI: Chairperson, Siddhartha Mohanty, Life Insurance Corporation of India, on Friday launched a new plan ‘LIC’s Jeevan Dhara II’ which will be available for sale from January 22, 2024.

“LIC’s Jeevan Dhara-II is an Individual, Savings, Deferred Annuity Plan and the Unique Identification Number (UIN) for LIC’s Jeevan Dhara-II is UIN: 512N364V01,” Mohanty said adding that minimum age at entry is 20 years (last birthday) for Annuitant/Primary/Secondary Annuitant and Maximum Age at entry is 80, 70, 65 years minus deferment period depending upon the annuity option chosen.

“The annuity is guaranteed from inception and 11 annuity options are available to prospective policyholders and there is higher annuity rates at higher ages,” he said adding that under the plan, life cover is available during deferment period.

“There is flexibility to choose from Regular Premium and Single Premium; Single Life Annuity and Joint Life Annuityl and Available Deferment Period [from 5 years to 15 years (in case of Regular Premium) and from 1 year to 15 years (in case of Single Premium)] i.e. when to start annuity payments as per your requirements,” he said adding that mode of Annuity payments (yearly, half-yearly, quarterly and monthly).

Annuity Option once chosen cannot be altered, he said.

“There is incentive for High Premium /Purchase price/ for Online Sale by way of increase in the annuity rate/ for existing Policyholders/Nominee/Beneficiary of the Corporation,” he said adding that there is an option to increase the Annuity (Top-up annuity) under the policy by paying additional premium as a Single Premium and at any time during the deferment period only and while the policy is in-force. Option to take death claim proceeds as Lump-sum, in the form of Annuitisation or in instalments, he said adding that there is option to receive a lump-sum amount in return of reduction in annuity payments and other benefits available under annuity options with Return of Premium/ Purchase Price.

“Loan facility shall be available during or after the deferment period under annuity options with Return of Premium/ Purchase Price,” he said adding that the Plan is a Non-Linked, Non-Participating Plan.

Benefits are payable under an in-force policy on Survival/Death of the Annuitant(s) under applicable Annuity Options selected, he said.

This Plan can be purchased Offline through agents / other intermediaries as well as Online directly through website www.licindia.in.